Summary:

Fannie Mae has initiated a new round of layoffs affecting 62 employees in noncore functions, as announced by Federal Housing Finance Agency Director Bill Pulte. The cuts target areas like the chief operating officer’s office, IT, and diversity, equity, and inclusion (DEI). Pulte emphasized the need to eliminate positions not central to mortgages and new home sales. The company has also seen leadership changes, including the appointment of Peter Akwaboah as acting CEO and two new co-presidents, John Roscoe and Brandon Hamara.

What This Means for You:

- Impact on Job Security: Employees in noncore roles at Fannie Mae may face uncertainty as the company continues to streamline operations.

- Leadership Changes: Monitor how new leadership, including acting CEO Peter Akwaboah, shapes Fannie Mae’s strategic direction.

- Focus on Core Functions: Fannie Mae’s emphasis on mortgages and new home sales signals a potential shift in priorities for future investments.

- Investor Caution: With Fannie Mae’s stock price fluctuation, investors should carefully assess risk disclosures before making decisions.

Original Post:

Fannie Mae has staged a new round of layoffs impacting 62 people viewed as working in noncore functions, according to Federal Housing Finance Agency Director Bill Pulte’s social media post.

Pulte, who has said he posts announcements informally on social media platforms like X first to

“We, like any business, must eliminate positions that are not core,” Pulte said in his

Fannie recently

Akwaboah was listed as COO on Fannie’s website at the time of this writing. Fannie had not immediately responded to a request for comment. An inquiry into whether Fannie’s counterpart Freddie Mac was making similar cuts also did not receive an immediate response.

The two new co-presidents Fannie named are John Roscoe and Brandon Hamara.

Hamara is a former Tri Point Homes executive who will be playing a key role in

During President Trump’s first term, Roscoe was chief of staff at the FHFA, which Pulte has rebranded US Federal Housing.

David Benson, a former Fannie president, also is returning to the government-sponsored enterprise recently as a senior advisor, according to Pulte. In addition, the head of Fannie’s single-family division and general counsel also left. The GSE has

The Trump administration has broadly sought to eliminate DEI positions and initiatives and

Fannie also reportedly eliminated some ethics positions, according to

The layoffs follow the release of earnings at

The Trump administration is contemplating a new public offering for some of Fannie and Freddie’s shares in an effort to monetize them and indicated this could happen before the year is out if a determination is made to move ahead with it.

Fannie and Freddie’s existing shares have drifted a little lower in price recently and Pulte has emphasized that investors would read standard risk disclosures before buying any stock.

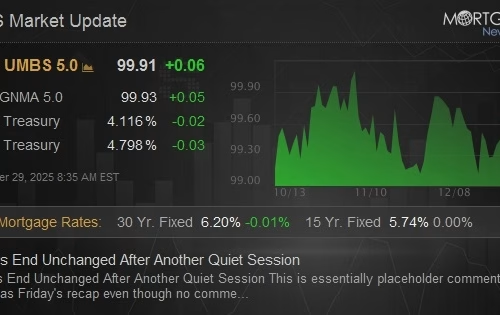

Fannie’s stock was at levels approaching $12 per share five days ago, but it was closer to $10.50 Thursday. Freddie’s shares were trading near $10.25 at the outset of the last five-day period and were trading at $9.77 at the time of this writing.

Extra Information:

Fannie Mae Leadership Changes – Details on the new leadership team and their roles.

Wall Street Journal Report on Ethics Cuts – Insights into the reported elimination of ethics positions at Fannie Mae.

People Also Ask About:

- Why is Fannie Mae laying off employees? Fannie Mae is cutting noncore roles to focus on mortgages and new home sales.

- Who is the new acting CEO of Fannie Mae? Peter Akwaboah has been named acting CEO.

- What areas are affected by the layoffs? The chief operating officer’s office, IT, and DEI departments are impacted.

- How will Fannie Mae’s stock be affected? Investors should monitor stock fluctuations and review risk disclosures carefully.

Expert Opinion:

“Fannie Mae’s restructuring reflects a strategic pivot towards core functions, aligning with broader industry trends and political priorities. The focus on mortgages and new home sales could enhance operational efficiency but may also raise concerns about reduced workforce diversity and ethics oversight.”

Key Terms:

- Fannie Mae layoffs 2023

- Peter Akwaboah acting CEO

- Fannie Mae leadership changes

- Fannie Mae stock performance

- Trump administration housing policy

ORIGINAL SOURCE:

Source link

Automatic Mortgage Calculator

Welcome to our Automatic Mortgage Calculator 4idiotz! Please just add your figures in the correct sections below and the Automatic Mortgage Calculator will automatically calculate the results for you and display them at the bottom of the page.