Summary:

Baby boomers (1946-1964) are increasingly abandoning 55+ retirement communities due to five financial pressures: skyrocketing HOA fees, insufficient healthcare infrastructure, isolation from family networks, unsustainable home maintenance costs, and challenging resale markets. These age-restricted developments – originally marketed as affordable alternatives to assisted living – now struggle with inflation-driven cost escalations and changing generational priorities. The trend signals a fundamental shift in senior housing preferences toward multigenerational options and hybrid living models.

What This Means for You:

- Budget for hidden costs: Calculate potential HOA fee increases (4-8% annually) and mandatory service contracts before purchasing in 55+ communities

- Evaluate care infrastructure: Prior to relocation, verify onsite Medicare-certified home health services and nursing facilities within 10-mile radius

- Assess mobility: Develop 5-year mobility plan accounting for potential assisted living transitions using Area V Agency on Aging resources

- Market warning: 55+ home inventories rose 17% YOY (2023) – consider selling before projected 2025 market saturation

Original Post:

As baby boomers entered their empty-nest years, developers spotted an opportunity. They began building 55+ communities — neighborhoods designed for active older adults, typically with golf courses, fitness centers and no-kids policies. For decades, these developments offered carefree retirement living.

But the tide is turning due to five financial realities:

- Soaring ownership costs: Average HOA fees now exceed $450/month (+22% since 2020) while property taxes and maintenance fees create unsustainable burdens for fixed incomes

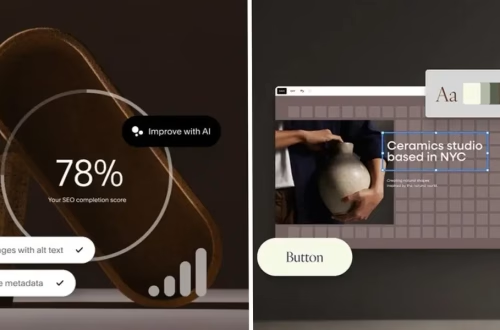

- Healthcare accessibility gaps: 78% of 55+ communities lack onsite medical services, forcing costly transitions to assisted living facilities averaging $5,350/month

- Intergenerational isolation: 63% of relocated boomers report regretting distance from family caregivers crucial for aging-in-place feasibility

- Maintenance mandates: Strict HOA covenants require professional landscaping and repairs, adding $8,000+/year in unavoidable expenses

- Resale vulnerabilities: Market saturation and Gen-X shortages create 22% longer selling periods compared to traditional housing

The next generation seeks hybrid solutions like co-housing and multigenerational developments that balance social connection with reduced financial exposure.

Extra Information:

- AARP Home Care Cost Calculator – Projects long-term care expenses by ZIP code

- NCOA Senior Economic Security Data – Benchmarks retirement budgets against inflation trends

- HUD Elderly Housing Database – Compares costs across 3,200+ senior communities

People Also Ask:

- What are alternatives to 55+ communities? Multigenerational housing cooperatives and NORCs (Naturally Occurring Retirement Communities) offer lower-cost age-friendly options

- How do 55+ HOA fees compare to assisted living? Average annual 55+ costs ($19k) now reach 35% of assisted living expenses despite offering fewer care services

- Can you rent in 55+ communities? Only 12% permit rentals – most enforce 80% owner-occupancy rules limiting flexibility

- Do 55+ homes appreciate slower? Yes – appreciation trails traditional homes by 1.3% annually due to restricted buyer pools

Expert Opinion:

“The 55+ model suffers from critical design flaws in today’s longevity economy,” states Dr. Susan Kahlenberg, senior housing economist at the Urban Institute. “Successful next-generation developments must integrate three pillars: modular care-service upgrades, intergenerational connectivity, and equity-protection mechanisms that guard against market volatility.”

Key Terms:

ORIGINAL SOURCE:

Source link