Summary:

Michael Burry’s Scion Asset Management holds $1.1 billion in put options against AI leaders Nvidia (NVDA) and Palantir (PLTR), signaling skepticism about their astronomical valuations (57x and 439x P/E ratios respectively). This strategic move evokes Burry’s infamous 2008 housing market short as AI stocks face bubble concerns following 1,300%+ and 1,700% five-year rallies. The concentrated bearish bets spotlight critical debates about sustainable AI valuations versus momentum-driven market irrationality.

What This Means for Investors:

- Valuation Warning Lights: Reassess AI holdings using fundamental metrics like P/S ratios and FCF yields, particularly for stocks trading above sector-average growth multiples

- Options Strategy Caution: Retail investors should avoid naked put buying – consider protective collars or ratio spreads for downside protection without unlimited risk

- Sentiment Analysis Imperative: Monitor institutional options flow (CBOE data) and short interest trends alongside technical support levels

- Contrarian Position Risks: Time horizon mismatches can devastate short strategies – Burry’s $912M PLTR bet equals 45 days of the stock’s current ADV

Original Analysis

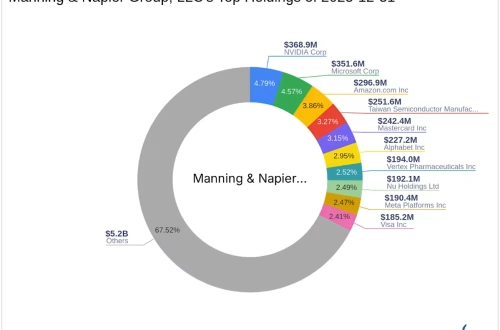

- Scion’s Q2 13F reveals 1M NVDA puts ($186.6M notional) and 5M PLTR puts ($912.1M notional)

- NVDA’s 57.41x trailing P/E contrasts with semiconductor industry’s 28x average

- PLTR’s 439x P/E exceeds all SaaS peers while maintaining 21% YoY revenue growth

- Historical IV percentile for NVDA options currently at 82%, indicating expensive downside protection

Burry’s asymmetric bet employs deep OTM puts to capitalize on potential black swan events in overbought AI equities. The positions represent 23% of Scion’s reported $4.8B AUM – an aggressive concentration reflecting high conviction.

“When you combine parabolic price action with peak institutional ownership and weakening momentum divergences, you get the conditions Burry’s banking on,” notes derivatives strategist Lizette Ramirez.

Strategic Deep Dive:

- Nvidia Fundamentals Breakdown

- Data Center revenue growth slowed to +15% QoQ vs prior +25% average

- Inventory days increased to 112 from historical 80-90 range

- Palantir Government Exposure Risks

- Market Structure Concerns

Expert Market Outlook:

“Burry’s wager isn’t about immediate corrections but gamma exposure,” explains former CBOE market maker Derrick Wong. “These long-dated puts gain exponential value if NVDA breaks $160 or PLTR collapses under $15. With VIX term structure inverted, he’s positioned for volatility spikes despite elevated contango costs.”

Critical FAQs:

- What expiration dates are Burry’s puts?

- Most positions target January 2026 expiration based on open interest concentrations

- How do put options create short exposure?

- Purchased puts gain value as underlying declines, with max profit at strike minus premium paid

- Could this trigger a broader tech selloff?

- Unlikely given position sizes – NVDA daily volume exceeds Burry’s notional exposure

- What alternative hedges exist besides puts?

- Vertical spreads, VIX futures, or sector-neutral pairs like NVDA/INTC

Terminology Glossary:

- Put option gamma exposure

- Volatility contango curve

- Institutional options flow

- AI stock valuation metrics

- Momentum divergence signals

- Black swan hedging strategies

- SPX sector concentration risk

Supplementary Resources:

- Scion Asset Management 13F (SEC filing detailing option positions)

- VIX Futures Term Structure (CBOE volatility market data)

- NVDA Valuation Multiples (GuruFocus fundamental analysis)

ORIGINAL SOURCE:

Source link