Summary:

Crypto analyst Pumpius predicts an unprecedented liquidity wave in global markets, driven by government stimulus, monetary easing, and corporate investments. XRP is highlighted as a key asset poised to capitalize on this surge, given its role in facilitating instant, cross-border transactions. This analysis draws parallels to the 2020 pandemic-induced market boom, suggesting similar conditions are emerging. With the U.S. national debt surpassing $38 trillion and major tech companies investing heavily in AI, XRP’s utility as a global settlement bridge positions it as a critical player in the forthcoming financial expansion.

What This Means for You:

- Monitor XRP closely as liquidity trends could drive significant price movements.

- Consider diversifying your portfolio with XRP to hedge against market volatility.

- Stay informed about Ripple’s partnerships and technological advancements for long-term investment insights.

- Prepare for potential market shifts as stimulus spending and corporate investments inject capital into global economies.

Analyst Says Don’t Get Left Behind As Massive Liquidity Wave Is Coming For XRP:

A crypto analyst known as Pumpius has issued a bold warning on social media platform X, declaring that a massive liquidity wave is about to sweep through global markets, and XRP could be the key asset positioned to capture it.

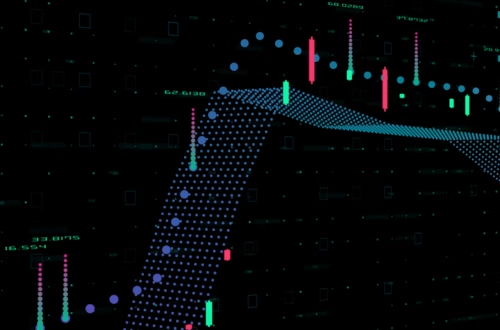

His post, shared alongside a chart of the US national debt now above $38 trillion, argues that a combination of government stimulus, monetary easing, and corporate spending is about to unleash a surge of capital unlike anything seen since the 2020 pandemic.

Liquidity Flood And The Return Of Stimulus Spending

In his analysis, Pumpius highlighted that the United States government is preparing to inject over $400 billion in new stimulus payments, and this is going to be the first direct round of such spending since 2021. This comes at a time when the Federal Reserve is cutting interest rates despite inflation still sitting above 3% and labor market data showing signs of cooling.

A similar setup in 2020 and 2021 during the COVID-19 pandemic led to an enormous wave of liquidity that lifted both traditional and crypto markets to record highs. Now, President Donald Trump has vowed to provide each American a $2,000 dividend to be distributed from what he said was tariff revenue.

The chart shown below illustrates a notable connection vividly: each major stimulus injection, from the $270 billion to $410 billion rounds, coincided with sharp jumps in the national debt and subsequent market expansions. With total US debt now projected to exceed $38 trillion, Pumpius believes another round of liquidity growth is close.

The analyst went on to point out that this time, the liquidity wave is not just based on government spending but also on private-sector investment on an extraordinary scale.

The so-called Magnificent 7 technology companies (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla) are collectively pouring over $100 billion every quarter into artificial intelligence infrastructure.

XRP Positioned As The Bridge For Global Capital Flow

According to Pumpius, all this incoming liquidity needs a bridge, an asset capable of settling large-value transactions instantly across borders. He described XRP as the only digital asset designed precisely for this purpose, built for institutional-grade, real-time settlement and capable of handling global capital flows efficiently.

Ripple’s technology already provides the financial infrastructure necessary to connect banks, fintechs, and payment systems that will need to move funds quickly as liquidity expands. “The math is simple,” he said. “The liquidity is coming. The rails are ready. Own XRP or be left behind,” he concluded.

XRP is one of the top-traded digital assets by volume, and market participants are watching closely to see how the cryptocurrency’s price action plays out.

Ripple, its parent technology company, has been making different partnership moves and company acquisitions to expand its reach. This is expected to hopefully boost XRP’s adoption on a global scale and, in turn, its price growth. At the time of writing, XRP is trading at $2.45, down by 1.4% in the past 24 hours.

Featured image from Adobe Stock, chart from Tradingview.com

Extra Information:

Ripple’s official website provides updates on its technology and partnerships. Federal Reserve updates offer insights into monetary policy changes driving liquidity. For real-time XRP price tracking, visit CoinGecko.

People Also Ask About:

- What is XRP? XRP is a digital asset designed for fast, low-cost cross-border transactions.

- Why is liquidity important in crypto? Liquidity ensures assets can be bought or sold without significantly affecting their price.

- How does stimulus spending affect crypto? Increased liquidity from stimulus can drive capital into crypto markets, boosting prices.

- What are Ripple’s partnerships? Ripple collaborates with banks and fintechs to expand XRP’s utility in global payments.

- Is XRP a good investment? XRP’s unique utility in global transactions makes it a potential long-term investment.

Expert Opinion:

Pumpius’ analysis underscores XRP’s strategic position in the evolving financial landscape. As global liquidity expands, XRP’s ability to handle cross-border transactions efficiently makes it a critical asset. Investors should prioritize understanding its technological edge and adoption trajectory to capitalize on this emerging opportunity.

Key Terms:

- XRP cryptocurrency

- Global liquidity wave

- Cross-border transactions

- Stimulus spending impact

- Ripple partnerships

- Crypto market expansion

- Institutional-grade blockchain

ORIGINAL SOURCE:

Source link