Summary:

REX Shares has announced the impending launch of the first US Dogecoin ETF (DOGE ETF), branded as the REX-Osprey™ DOGE ETF (DOJE). This ETF aims to provide investors with exposure to Dogecoin’s performance through a unique structure under the Investment Company Act of 1940. The announcement comes despite several pending spot Dogecoin ETF applications with the SEC, as REX leverages a regulatory pathway that could allow for a faster launch. The fund will utilize a mix of direct Dogecoin holdings and derivatives to mirror its price, marking a significant milestone in the evolution of crypto ETFs.

What This Means for You:

- Access to Dogecoin Exposure: Investors seeking exposure to Dogecoin without directly purchasing the cryptocurrency can now consider the DOGE ETF as a regulated alternative.

- Faster Market Entry: Unlike traditional spot ETFs, REX’s 1940-Act structure bypasses the need for a 19b-4 exchange rule change, potentially accelerating its launch.

- Diversification Potential: The ETF’s ability to use derivatives and a Cayman subsidiary adds flexibility in achieving Dogecoin exposure while adhering to regulatory requirements.

- Regulatory Watch: Keep an eye on SEC decisions, as the registration must still go effective and an exchange must approve the listing for the ETF to trade.

First Dogecoin ETF ‘Coming Soon’: REX-Osprey Teases Launch

REX Shares says it’s preparing to list what it calls the first US Dogecoin ETF, teasing the product on X even as multiple spot DOGE ETF applications remain pending at the Securities and Exchange Commission. Via X, REX Shares wrote on Wednesday: “The REX-Osprey™ DOGE ETF, DOJE, is coming soon! DOJE will be the first ETF to deliver investors exposure to the performance of the iconic memecoin, Dogecoin. From REX-Osprey™, the team behind $SSK, the first SOL + Staking ETF.”

The product traces back to a January 21, 2025 SEC filing for a suite of crypto funds under the ETF Opportunities Trust, which included a REX-Osprey DOGE ETF alongside BTC, ETH, SOL, XRP, BONK and TRUMP-token funds. In that registration, the DOGE fund’s mandate is explicit: it “seeks investment results, before fees and expenses, that correspond to the performance of Dogecoin.”

Can REX-Osprey Launch Their Dogecoin ETF First?

The apparent paradox—how REX can “launch” a DOGE ETF while spot Dogecoin ETPs are still in the SEC queue—comes down to structure. Most DOGE proposals on file are commodity-based grantor trusts or similar vehicles that require an exchange rule change under the Securities Exchange Act (a so-called 19b-4) before they can list.

Bitwise, for example, filed to list a Dogecoin ETF on NYSE Arca through that pathway, and Nasdaq has a pending proposal to list the 21Shares Dogecoin ETF. By contrast, REX’s DOGE product sits inside a 1940-Act open-end ETF trust, which registers under the Investment Company Act via a post-effective amendment (Form 485(a)) and, if the registration goes effective and an exchange accepts the listing under its generic ETF standards, can come to market without waiting on a bespoke 19b-4 order.

That is the same playbook REX and Osprey used to bring their Solana + Staking ETF to market in July. Basically, the structure is similar to how futures ETFs work.

The January prospectus also explains how exposure works. The DOGE fund will invest “at least 80%” of assets in Dogecoin or instruments providing DOGE exposure and may use “derivatives,” including futures and swaps. Like REX-Osprey’s other single-coin funds, it relies on a wholly owned Cayman subsidiary—the “REX-Osprey DOGE (Cayman) Portfolio S.P.”—to hold certain positions; the parent ETF’s investment in that sub is capped at 25% of total assets to preserve regulated investment company (RIC) tax treatment.

In plain terms, it’s a ‘40-Act ETF that aims to mirror DOGE’s price, using a mix of direct exposure (including via the Cayman sub) and, where available, derivatives.

Meanwhile, the “traditional” spot DOGE race is active but unresolved. NYSE Arca’s filing for a Bitwise Dogecoin ETF and Nasdaq’s proposal for a 21Shares Dogecoin ETF are both on the public docket, and Grayscale submitted an S-1 to list a Dogecoin fund in mid-August. Those products would be commodity ETPs requiring an exchange rule change before trading can begin—hence the longer timeline.

Notably, there is also a clear precedent for REX finding a regulatory niche: on July 2, 2025, the REX-Osprey Solana + Staking ETF (ticker SSK) listed on Cboe as a ‘40-Act fund that passes through native staking rewards to shareholders. Cboe’s own listing page describes it succinctly: the fund seeks the performance of Solana “plus staking rewards associated with the Reference Asset.”

REX’s release heralded it as “the first US-listed ETF to give investors exposure to Solana… plus staking rewards” in brokerage accounts. That was possible because the assets and mechanics fit within a ‘40-Act ETF framework augmented by a Cayman subsidiary and—in SSK’s early months—a C-corp tax wrapper that has since been converted to RIC status.

The parallels—up to a point—are real. REX is again using the ‘40-Act ETF chassis, the ETF Opportunities Trust umbrella and Cayman subs to pursue single-coin exposure without waiting for a new 19b-4 approval. But an important difference is technical and conclusive: Dogecoin is a proof-of-work cryptocurrency (merged-mined with Litecoin), so there is no native staking yield to pass through.

As for timing and status, REX’s X post is a teaser, not a notice of effectiveness. The January 21 filing is a subject-to-completion prospectus; the SEC must allow the registration to go effective, and an exchange must accept the listing.

Separately, the SEC is also weighing “generic” listing standards for commodity- and crypto-based ETPs—rules that, if adopted, could streamline new crypto listings generally—though those proposals are independent of REX’s ‘40-Act path. In short, REX can plausibly be first precisely because it isn’t waiting on a DOGE-specific 19b-4 approval, but the fund still needs its registration to clear and a listing venue to post a trading date.

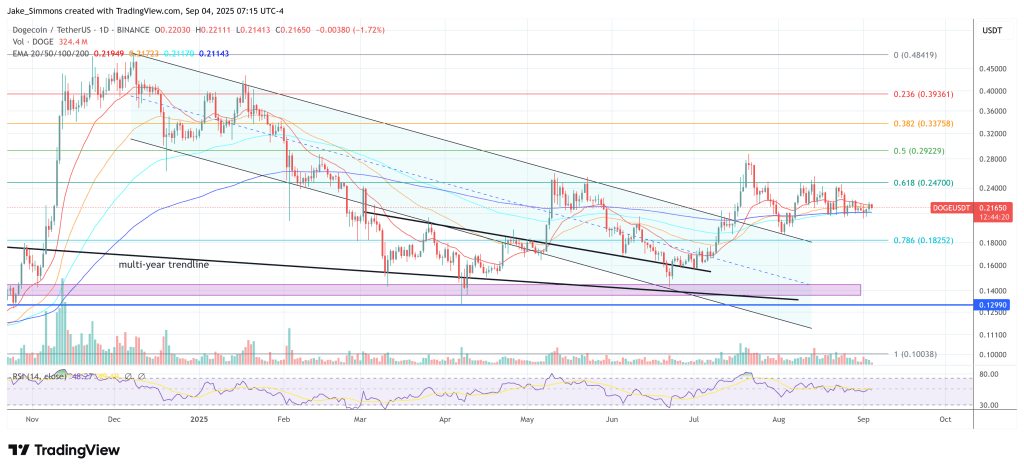

At press time, DOGE traded at $0.2165.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Extra Information:

For further reading, explore Bitwise’s spot Dogecoin ETF filing and REX-Osprey’s Solana + Staking ETF, which offer insights into the regulatory and structural nuances of crypto ETFs.

People Also Ask About:

- What is a Dogecoin ETF? A Dogecoin ETF is an exchange-traded fund that provides exposure to Dogecoin without requiring direct ownership of the cryptocurrency.

- How does a 1940-Act ETF differ from a spot ETF? A 1940-Act ETF operates under the Investment Company Act of 1940, allowing for streamlined registration and listing compared to spot ETFs, which require a 19b-4 exchange rule change.

- When will the REX-Osprey DOGE ETF launch? The exact launch date is pending SEC registration effectiveness and exchange approval, but REX has teased it as “coming soon.”

- What are the risks of investing in a Dogecoin ETF? Investors face risks tied to Dogecoin’s price volatility, regulatory changes, and the ETF’s reliance on derivatives and subsidiaries for exposure.

Expert Opinion:

The REX-Osprey DOGE ETF represents a pivotal development in crypto investment vehicles, leveraging regulatory innovation to provide quicker market access. Its success could pave the way for more niche crypto ETFs, but investors should remain cautious of the inherent volatility and technical complexities associated with such products.

Key Terms:

- Dogecoin ETF

- REX-Osprey DOGE ETF

- 1940-Act ETF

- Cryptocurrency derivatives

- SEC crypto regulations

- Proof-of-work cryptocurrency

- Cayman subsidiary structure

ORIGINAL SOURCE:

Source link