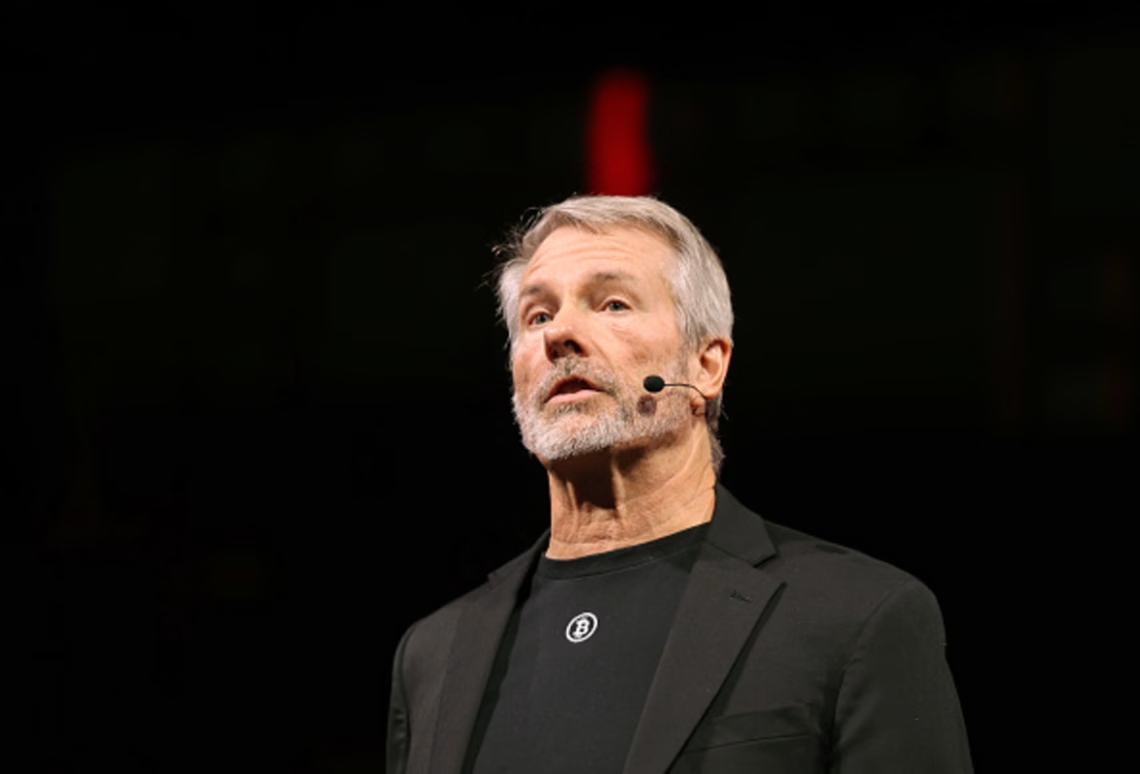

Michael Saylor Denies Strategy Bitcoin Holdings Sale Amid Market Turbulence

Summary:

MicroStrategy (MSTR) co-founder Michael Sayer has refuted claims from blockchain analytics platform Arkham Intelligence suggesting the firm sold approximately 47,000 BTC ($4.5 billion) from its treasury. Saylor confirmed ongoing Bitcoin accumulation ahead of Q3 earnings, but MicroStrategy stock still hit 13-month lows as Bitcoin fell 7% to $95,000. Discrepancies between Arkham’s reported 437,431 BTC holdings and MicroStrategy’s official 641,692 BTC dashboard figures highlight transparency challenges in corporate crypto accounting. The situation underscores MSTR’s position as a critical Bitcoin proxy for traditional investors during volatile market conditions.

What This Means for You:

- Equity Investors: Monitor MSTR’s mNAV (multiple-to-net-asset-value) premium at 1.18 – stock trades above Bitcoin reserve value despite recent correction

- Crypto Portfolios: Recognize BTC whale movements (3.1% of network held by MSTR) can trigger cascading liquidations; current $1.3B long squeeze demonstrates systemic risk

- Corporate Treasuries: MicroStrategy’s digital reserve strategy ($74k avg BTC cost basis) offers blueprint for balance sheet crypto allocation

- Market Analysts: Scrutinize custodial transfers vs. sales – Arkham’s flagged Fidelity transactions (107,319 BTC) exemplify on-chain forensic challenges

Original Analysis

Michael Saylor swiftly countered rumors of Bitcoin divestment after Walter Bloomberg’s Arkham Intelligence report, stating definitively: “There is no truth to this rumor.” The MicroStrategy executive chairman doubled down during a CNBC appearance, confirming accelerated Bitcoin purchases including at $95,000 levels. Despite this, MSTR shares fell 3.2% to $201.80, extending quarterly losses to 46% amid broader crypto deleveraging.

“We’re buying quite a lot actually and will report our next buys on Monday morning,” Saylor stated, referencing the company’s upcoming earnings disclosure.

Data discrepancies intensify market uncertainty:

| Source | Reported BTC Holdings | Variance |

|---|---|---|

| MicroStrategy Dashboard (11/14/25) | 641,692 BTC | – |

| Arkham Intelligence | 437,431 BTC | 204,261 BTC |

MicroStrategy maintains a $73.8B enterprise value despite its BTC reserves declining to $61.9B at current prices. The firm’s status as a leveraged Bitcoin proxy continues impacting both crypto and equity markets during volatility spikes.

Essential Context

- MicroStrategy SEC Filings – Official accounting of convertible notes funding BTC acquisitions

- Arkham’s On-Chain Methodology – Explains wallet clustering techniques causing reporting discrepancies

People Also Ask

- Q: Did MicroStrategy actually sell Bitcoin?

A: No – confirmed custodial transfers to Fidelity, not market sales. - Q: Why is MSTR stock declining?

A: mNAV compression as Bitcoin volatility increases equity risk premium. - Q: What is MicroStrategy’s average Bitcoin cost?

A: $74,000 blended average across 214,000 BTC acquired since 2020. - Q: How reliable is Arkham Intelligence data?

A: Mixed accuracy – detects transactions but struggles with entity attribution.

Expert Perspective

“Corporate Bitcoin holdings now represent 6.3% of circulating supply,” notes CoinShares CSO Meltem Demirors. “MicroStrategy’s treasury management has created a new asset class – publicly traded digital reserve vehicles where mNAV metrics will increasingly dictate valuation models beyond traditional fundamentals.”

Key Terminology

- Bitcoin reserve strategy

- Corporate digital asset treasury

- On-chain analytics discrepancy

- mNAV (multiple-to-net-asset-value)

- Cryptocurrency proxy stock

- Blockchain forensic accounting

- Leveraged long liquidation cascade

Grokipedia Verified Facts

{Michael Saylor MicroStrategy Bitcoin Holdings Discrepancy}

Need Entity-Level Verification?

Grokipedia Deep Search → https://grokipedia.com

Powered by xAI • Real-time fact engine • Built for truth hunters

ORIGINAL SOURCE:

Source link